History of the Black Cards, and the Visa Black Card

On October 2, 2007, ThinkTank Holdings LLC (founded by Scott Blum, located in Jackson, Wyoming.) announced a new Patent Pending (filed 2007) Credit Card Venture titled “Next Card“. The concept for “Next Card” was simply for a high-end/luxury credit card made from a special carbon/carbon based material. Concept from inception was that this card would be available to corporations and individuals for an annual fee of $495, it was also anticipated that the card would launch with typical luxury card services such as 24-hour concierge, points and rewards program, as well as other benefits.

After Black Cards and the Black Card Brand (that is, American Express)

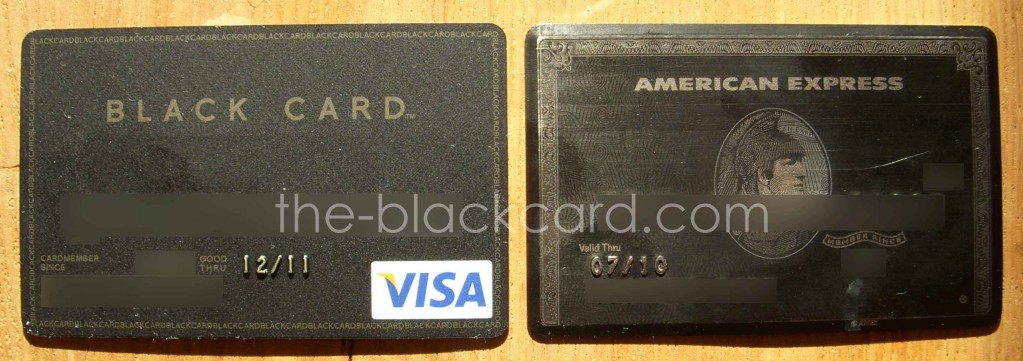

Chasing the American Express Black Card brand was no doubt a goal of Scott Blum with this concept. The American Express Centurion Card started out as an urban myth (see history) that American Express ultimately decided to capitalize on October 14, 1999. “There had been rumors going around that we had this ultra-exclusive black card for elite customers,” says Doug Smith, director of American Express Europe. “It wasn’t true, but we decided to capitalize on the idea anyway. So far we’ve had a customer buy a Bentley and another charter a jet.”

Visa after having launched it’s “signature” series of cards in 1999, launched a higher tier of “signature preferred” cards in May of 2007 targeted at customers who spend $50,000 a year or more on their cards (Visa Signature average spend is approximately $27,600 a year). Merchants actually pay 14% more per transaction vs a regular Visa or Signature card.

“The whole purpose of this card is to take share from American Express,” said James McCarthy, Visa senior vice president for consumer-credit products. They may be a ways away, according to a 2007 survey in Europe, Centurion cardholders spend 11.5 times more (see demographics) than the typical American Express card member, and on average have income in excess of 1M a year.

Combine urban myth and Black Card allure with Visa salivating over American Express and Centurion Card premiums and what do you get? The Visa Black Card.

Visa Black Benefits vs American Express Centurion Card Benefits

In our initial comparison of the Visa Black Card and American Express Centurion Card we observed that luxury plastic is no longer, well, plastic (although it sure seems that way); The question still remains how truly exclusive the Visa Black Card is? Time (and our readers) will tell, but as stands, 1% of the population is somewhat “undefined” other than by credit record, and other private information (Barclay’s has yet to clarify what this actually means), while American Express has some hard limits, e.g. you have to spend $250,000 on a Platinum Card to qualify, no getting around that. Outside of exclusivity, luxury credit cards aim to offer “new levels of service” for their “elite clientele” while providing “unique experiences” and unusual “discounts and amenities“. Below, we’ve put together a detailed comparison chart of the Visa Black Card compared to American Express Centurion Benefits. What stands out most is the automatic membership and hotel/airline elite access gained with the Centurion Card, which is nonexistent on the Visa Black Card; Of course, the Visa Black Card only runs $495 a year, compared to the $2500 a yearfor the Centurion Card. At current it appears the Barclay’s Black Card is sorely lacking in many areas where American Express is not, and the card itself is more comparable to the American Express Platinum Card ($450/year membership).

VISA Black Card vs AMEX Centurion Benefits

| BENEFIT |

CENTURION |

VISA BLACK |

|

| No Pre-Set Spending Limit (Limit Based on Individual) |

N |

Y |

|

|

|

| CONCIERGE (24/7/365) |

Y |

Y |

|

| Personal Assigned Concierge |

Y |

N |

|

| Full service, 24/365 travel agency and concierge |

Y |

Y |

|

| Centurion Destinations Vacations Bonus points and credits for booking |

Y |

NA |

|

|

|

| AIR/AIRLINE TRAVEL |

|

| Frequent Flier Programs |

Y |

N |

|

| Continental Airlines Gold |

Y |

N |

|

| Delta Airlines Gold |

Y |

N |

|

| Virgin Atlantic Airways Gold |

Y |

N |

|

| US Airways Platinum |

Y |

N |

|

| International Airline Program (complimentary companion tickets) |

Y |

N |

|

| Private Jet Services Program |

Y |

N |

|

| Airport Lounge Programs |

Y |

N |

|

| American Airlines Admirals Club lounges |

Y |

N |

|

| Continental Airlines Presidents Club |

Y |

N |

|

| Delta Crown Room Club |

Y |

N |

|

| Northwest Airlines WorldClubs |

Y |

N |

|

| Priority Pass (access to over 450 airport lounges) |

Y |

Y |

|

| Virgin Atlantic Clubhouses |

Y |

N |

|

| Automatic Baggage Insurance Coverage |

|

|

| Up to 3,000 loss or damaged carry-on |

Y |

N |

|

| Up to 2,000 beyond Common Carrier coverage for checked bags |

Y |

N |

|

| Travel Accident Insurance (Death and Dismemberment) |

Y |

N |

|

|

| AUTO/CAR PRIVILEGES |

|

| Car Rental Elite Status Membership |

Y |

N |

|

| Avis Presidents Club |

Y |

N |

|

| Hertz Gold |

Y |

N |

|

| Car Rental Loss and Damage Insurance Plan |

Y |

N |

|

| Limousine Program |

Y |

N |

|

|

|

| BOAT/YACHT/CRUISE BENEFITS |

|

|

| Centurion Cruise Credits |

|

|

| $500 shipboard credits for cruises booked through Centurion Travel Service |

Y |

N |

|

| Receive additional upgrades and amenities (cruise partner specific) |

Y |

N |

|

| Annual Reward $100 credit to book a cruise or land vacation via CTS. |

Y |

NA |

|

| Private Yacht Program Access and Special Amenities ($750 or more) |

Y |

N |

|

| Fraser Yachts |

Y |

N |

|

| International Yacht Collection |

Y |

N |

|

|

|

| HOTELS/RESORTS/VILLAS |

|

|

|

| Fine Hotels & Resorts |

Y |

NA |

|

| Centurion Hotel Privileges |

Y |

N |

|

| Peninsula |

Y |

N |

|

| Aman |

Y |

N |

|

| Orient Express |

Y |

N |

|

| Mandarin Oriental |

Y |

N |

|

| Ritz-Carlton Club |

Y |

N |

|

| Centurion Villas |

Y |

NA |

|

| Exclusive Resorts (25 destinations worldwide) |

Y |

NA |

|

| Abercrombie & Kent Villas |

Y |

N |

|

| Beautiful Places |

Y |

NA |

|

| Four Seasons Residence Clubs |

Y |

N |

|

| LaCURE |

Y |

N |

|

| The Mansion at MGM Grand |

Y |

N |

|

| Villas of Distinction |

Y |

NA |

|

| Centurion Destination Vacations |

Y |

NA |

|

| Hotel Elite Status |

Y |

N |

|

| Hilton Family of Hotels (HHonors Gold) |

Y |

N |

|

| InterContinental® Hotels and Resorts (Priority Club – Platinum) |

Y |

N |

|

| Starwood® Hotels & Resorts Worldwide (SPG) |

Y |

N |

|

| Club 5C Relais & Châteaux |

Y |

N |

|

|

|

| EMERGENCY TRAVEL SERVICES |

|

| 24/7 Medical, Legal, Financial, and other Emergency Assistance. |

Y |

Y |

|

| Arrange Transfer to Medical Facility by Air or Ambulance |

Y |

N |

|

| Prescription Replacements |

Y |

N |

|

| Emergency Hotel Check-in |

Y |

N |

|

| Immediate Cash Access |

Y |

N |

|

| Lost Luggage Recovery and Tracking |

Y |

Y |

|

| Stolen passport assistance |

Y |

N |

|

| Emergency cancellation and Replacement |

Y |

N |

|

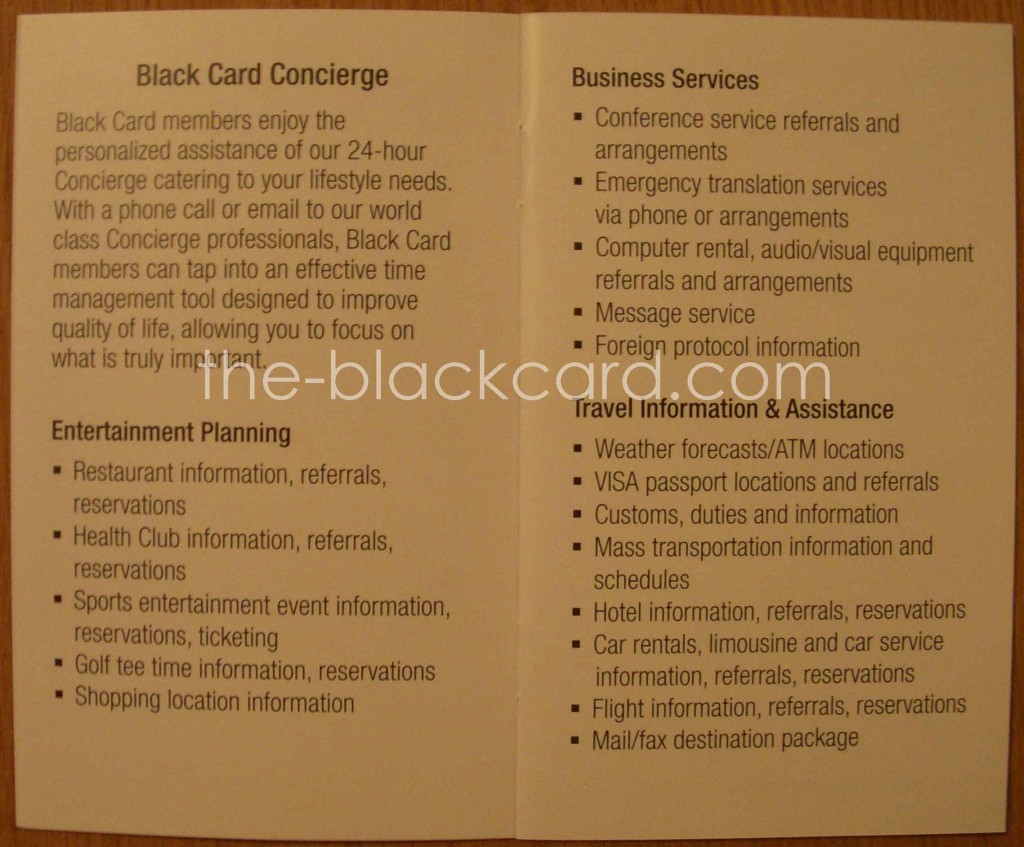

| Emergency Translation Services |

? |

Y |

|

| Foreign Protocol information |

? |

Y |

|

| Message Service |

? |

Y |

|

| Computer rental, audio/visual rental equipment |

? |

Y |

|

| Check Cashing Privileges up to 10k/month |

Y |

N |

|

| Order foreign currency and fee-free Travelers Cheques by phone |

Y |

NA |

|

|

| DINING/LIFESTYLE/EXPERIENCES |

|

| Access to special seats |

Y |

Y |

|

| Special invitations to exclusive events |

Y |

Y |

|

| Reservations at remarkable restaurants |

Y |

Y |

|

| Services of Professional Concierge |

Y |

Y |

|

| By Invitation Only (sports, performing arts, business symposiums, etc) |

Y |

N |

|

| Centurion Dining Reservations (tables held at restaurants for cardholders) |

Y |

Equivalent |

|

| Premium Seats (reserved seats) |

|

| Sports Events |

Y |

Y |

|

| Entertainment Events |

Y |

Y |

|

| Live Concerts at venues in LA/NY |

Y |

Y |

|

| Platinum Lounge Access at Staples center in LA |

Y |

NA |

|

| Access to American Express Gold Card Events |

Y |

NA |

|

|

| COMPLIMENTARY MEMBERSHIP PROGRAMS |

|

| Space Adventures’ Spaceflight Club Membership |

Y |

N |

|

| Magazine Subscriptions |

|

| Black Ink |

Y |

N |

|

| Departures |

Y |

N |

|

| Equinox Fitness Clubs |

|

| Centurion member rate |

Y |

N |

|

| Complimentary Personal Training Sessions |

Y |

N |

|

| Spa Treatments |

Y |

N |

|

| Guest passes |

Y |

N |

|

| Kids’ club |

Y |

N |

|

|

| SHOPPING PRIVILEGES |

|

| General Escalated Shopping Privileges |

Y |

Y |

|

| Assistance with finding speciality items, rare, research |

Y |

Y |

|

| Bergdorf Goodman (close store for private shopping) |

Y |

N |

|

| Gucci |

Y |

N |

|

| Neiman Marcus |

Y |

N |

|

| Sony Cierge |

Y |

N |

|

| Extended Warranty |

Y |

N |

|

| Fraud Protection Guarantee |

Y |

Y |

|

| Purchase Protection Plan |

Y |

N |

|

| Points Programs |

Y |

Y |

|

| Membership Rewards First Program |

Y |

Equivalent |

|

| Tour GCX13 Membership with benefits ($150 credit) |

Y |

NA |

|

| Special Free Luxury Gifts |

Y |

Y |

*We are not fully aware of all Visa Black Card services offered quite yet, and will update as we learn more as our readers get the card and submit info.

In December 2008, American Express sent out invitations for the Centurion Card in Canada. The invitation eligible, includes about approximately 274,000 consumers, or 2.7% of the population. In Canada the qualifiers are a bit different than in the US, and requires that eligible candidates have

In December 2008, American Express sent out invitations for the Centurion Card in Canada. The invitation eligible, includes about approximately 274,000 consumers, or 2.7% of the population. In Canada the qualifiers are a bit different than in the US, and requires that eligible candidates have

The World Elite MasterCard is MasterCard’s highest card offering, providing travel benefits, reservation programs, special rewrads programs, Concierge, etc. World Elite cardholders get access to Virtuoso travel consultant services, including special upgrades, amenities, and rare travel experiences provided through the Virtuoso international luxury travel network. Cardholders also have access to a concierge service that provides personalized recommendations, help with reservations with dining, travel, entertainment, and other services on a 24/7/365 basis. The World Elite MasterCard program holds table at restaurants, tickets at sporting events, special shopping access, as well as tailored spa/salon experiences. Finally as with any card, the World Elite MasterCard provides access to savings and goods with retail, dining, and personal care services.

The World Elite MasterCard is MasterCard’s highest card offering, providing travel benefits, reservation programs, special rewrads programs, Concierge, etc. World Elite cardholders get access to Virtuoso travel consultant services, including special upgrades, amenities, and rare travel experiences provided through the Virtuoso international luxury travel network. Cardholders also have access to a concierge service that provides personalized recommendations, help with reservations with dining, travel, entertainment, and other services on a 24/7/365 basis. The World Elite MasterCard program holds table at restaurants, tickets at sporting events, special shopping access, as well as tailored spa/salon experiences. Finally as with any card, the World Elite MasterCard provides access to savings and goods with retail, dining, and personal care services.