Posted on September 18, 2009.

We conducted an interview with one of our readers who happens to hold the American Express Centurion Card, Visa Signature Card, as well as MasterCard World Elite. We thank the reader much for their anonymous support, read on!

What do you consider a luxury or premium credit card?

A premium card would be anything that necessitates a particular financial situation to be approved. This can be total account relationship (Dollar Account) with a bank, level of income, total spend, etc.

Obviously for anything to be premium or luxury it must also contain additional benefits that are out of the ordinary for other credit cards of that type or by that issuer.

What luxury credit cards do you currently use?

- AMEX Centurion

- AMEX Platinum

- Visa Signature

- MasterCard World

Which card is your favorite?

Tough call

- As luxury and premium goes, the AMEX Centurion beats any other card hands down.

- Value for Money, I would suggest AMEX Platinum, as it gives many of the benefits (Such as a premium protection, concierge, lounge access, etc) For a relatively affordable price. Simply joining one of the airlines’ lounge programs already is the price of the AMEX Platinum – and anyone who qualifies for it would be ill-advised to join an airline lounge for that reason alone.

Why do you find best about the card?

Number one has to be the reciprocal arrangements with airlines and hotels to provide elite status in their programs.

Second place is the personal service (no waiting on hold, or being allocated random administrators overseas) and personal concierge.

Third place is the occasional bonus and promotional offers with co-marketing partners such as freebies from stores, hotels, and high-end brands.

I would not count the “recognition” of a black card as a benefit. Your own attitude and personal-skills do more than a piece of metal clanging arrogantly on a counter.

What are benefits do you find are best (points, miles, gifts, privileged access to events, etc)?

Points and miles are surely a benefit, though I haven’t used nearly as much as I earn. I have hundreds of thousands of points in all kinds of programs and earn them quicker than I can (or want to) use them.

Privileged access to events is a very nice benefit – Although in the current economy these events have been significantly scaled down in quantity and quality. Marketing-partners simply aren’t as active in wooing what are perceived to be “Elite potential clients.”

Who do you think has generally the best points program?

The best points program is AMEX in general, and the SPG AMEX in particular.

Why?

Every dollar charged is at least one point. One point is transferable to a wide range of airlines at a rate of 1.25 miles per points, which means that a business class ticket to europe can be had for no more than 80k points.

Also, the redemption rates with Starwood brand hotels are second to none, as long as you accumulate 1 point per dollar, which is only available on that card. Stays at their hotels earn much more.

How about rewards and trips program?

Not sure of the difference.

How do some of the luxury credit card concierge programs stack up eg. Virtuouso vs Centurion (Circle Associates)?

Circles is normally mentioned as being a superior company. I can’t comment more accurately regarding Virtuoso as I haven’t recently used them.

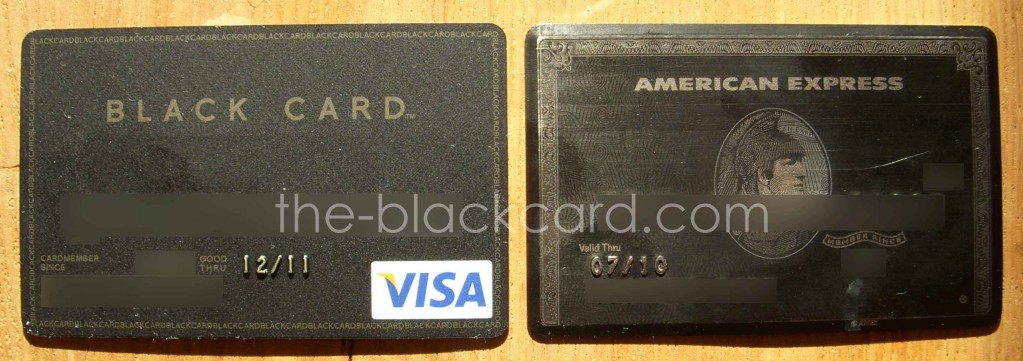

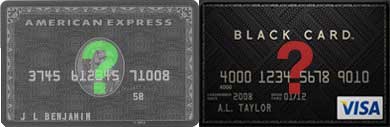

I can say that VIP desk (Which is that Visa Black uses) is traditionally trashed as being very inferior to all other concierge outfits. Again, this is based on hundreds of other personal-accounts rather than my own. I wouldn’t be daft enough to get a Visa Black myself.

What are your thoughts on the various programs eg. Visa Signature vs MasterCard World Elite vs American Express Centurion?

Here it is really applies to oranges.

The apple is AMEX Centurion

The oranges are Visa Signature and MC World / World Elite.

The former has a particularly high annual fee, as well as an even higher application fee and restrictive qualification criteria. The later are usually available for free, if you qualify.

MC World Elite, to my knowledge is only currently offered through two partners: Saks and Ameriprise. Although this is marketed as the most premium product offered by MC, its benefits are much more thin than the AMEX centurion (or even platinum):

- No airline elite nor lounge partners (a priority pass card is offered, which costs $27 per guest per visit, after the first few “introductory” uses – AMEX is free and totally unlimited).

- Very thin hotel partners (800 worldwide in total) with less benefits than the usual AMEX fine hotels and resorts program available to platinum members for free as well. In order to receive “an additional amenity” at the hotels, you must book and pay for a suite (with AMEX you can book any room you like, as basic as possible).

- Ridiculous car rental “elite” privileges: namely “free membership in emerald club” from national. Nothing else. Anyone can join emerald club for free without being “special” at all.

Since AMEX controls both sides, bank and card, do you find they have an advantage?

Arguable about what you would consider controlling both sides. Very few people “bank” with AMEX (their bank is called centurion bank – no connection to the black card) and AMEX also is offered (under license) by most unaffiliated banks.

If you refer to those cards issued directly from and managed by AMEX – then they may even have a disadvantage since almost nobody has an actual banking relationship with them. Therefore, you hear more nightmare stories about credit limits, declines, and cancellations from them – as they cannot gauge a complete profile of a customer, not having access to their bank balance information, earning and direct deposits, and other relationship history. When was the last time you met an account manager at AMEX? Now when was the last time you met a manager at your own bank (which issues all types of credit cards)?

What benefit would you love for American Express to bring back to the Centurion card (Everyone typically wants SPG Platinum)?

Yes, everyone typically laments the loss of SPG Platinum. People forget the loss of Hyatt Diamond as well.

Currently, the only “Elite Membership” offered is Gold SPG, Gold Hilton, and Platinum Holiday Inn = all of those can be obtained for free, with zero hotel stays, simply by having and using their own co-branded credit cards.

I would love for AMEX to bring back any type of hotel elite status that actually cannot just be obtained for free with no stays at all – otherwise the hotel chain doesn’t really treat you as a particular VIP since there are so many thousands of these Gold status members floating around who aren’t even loyal at all to the hotel chain.

SPG Platinum is one; Hyatt Diamond is another, Intercontinental Royal Ambassador is another.

Also – bring in at least one airline partner with a top level elite tier. No need to have several mid-tier partners within the same alliance (like Delta and Continental) and none in another (like Oneworld). Delta now has 4 tiers, and Centurion (so far) only gives you the 2nd level up, not even the 3rd…

Do you think AMEX should raise the requirements beyond 250k?

The “requirements” have been diluted by allowing business spend to count towards the threshold. Three or four years ago, there were only 14,000 members; today there are 27,000 and rising. The introduction of the $5,000 initiation fee prevented that from being 50,000 or more, but currently you can obtain a centurion simply as an employee of a company which has very mediocre monthly expenses paid on a business card. How many new cardholders have declined such freebies as $500 towards a purchase of $1000 or more in a retail partner – since they would never afford to even spend the extra $500 there?

There are 20 something year old kids who play PayPal games (of charging their AMEX card to pay themselves back) just to get a centurion card, or who charge the monthly advertising expenses for the company they work for (as a simple midlevel project coordinator) and get a black card? It’s becoming diluted somewhat – which, in my opinion, prevents AMEX from offering better elite benefits or removing old ones.

One idea would be to leave the 250k as it is, but only for personal cards. Business cards should be 500k. And you cannot switch between a business and a personal.

Would you pay more annual fees for some really awesome benefits (I think we all might)?

Very very hard to say. I believe that almost nobody takes advantage of every single one of the benefits that centurion offers. If you did, you would qualify for elite status independently.

In that case, to raise the fees would alienate the existing ranks, who are the original vip customers to begin with. We would all like to see awesome benefits, but not to pay more than $2,500 which in this economy is excessive to begin with.

A solution would be to offer new, really “awesome” benefits but you select which ones you want. For example, the highest tier airline status offered in a choice of 4 partners – of which you choose 1 and 2nd tier in 2 more. That way AMEX keeps their expenses to a reasonable level, members get higher benefits in items which help them, and people don’t end up paying for what they don’t need.

Which banks do you think offer the best programs?

Bank of America, Citibank, Chase and Wells Fargo all have attractive programs for private banking customers – which are their elite/premium accounts. They are each good for their own.

Do you have a great experience where a luxury card has really made a difference?

A week before Christmas, I tried booking a table at a Manhattan restaurant for that same evening but was told that they were booked with holiday reservations until the end of December. The restaurant was not a participant in any special AMEX or visa signature “hot tables” program, so I did not think to waste time booking through a concierge.

I spoke to the manager, explained that I was a good customer, and did not want a large table or group reservation – just 2 couples. Nothing could be done to “squeeze me in” that day, nor even later that week.

One call to Centurion, asking for help to find any available time that evening or even for the rest of the week – and the concierge asked “can I place you on hold while I check with the restaurant?”.

60 seconds later, the concierge comes back on the line and says “what time and day do you want a booking for 4? Pick what you like”. I said “I would love today in 2 hours – but I will take anything at all they can squeeze in, at any time”. Another 60 seconds on hold and I am told “everything is set for today in 2 hours, is there anything else i can help you with?”.

Amazingly, when i arrived at the restaurant, there was a line out the door, people were waiting more than 30 minutes for their pre-reserved tables to be available. One person was even arguing about the fact that there seemed to be a clean table in the center which was empty – they were told “it is not a table in use today”. I then asked about my own party of 4 and that i also had a reservation, and was told “it will be a bit of a wait, we are very busy today, can i have your name?” one glance at the list, and “right this way sir” to that elusive empty table (much to the annoyed, or impressed, glances of the other waiting people)…

I still have no idea what the concierge said, or to whom it was said – but I was thoroughly impressed.

I’m sure you have a few bad experiences to share?

Yes there are, and some are better left unshared…

If you’re in NY, exhibit is held @

If you’re in NY, exhibit is held @

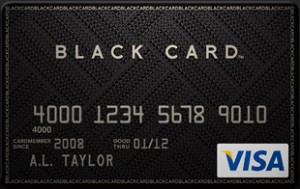

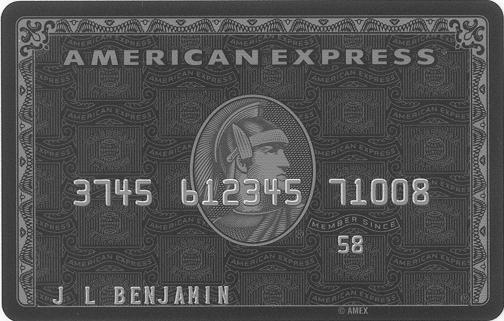

Paper, Plastic, Titanium, and Carbon Graphite?

Paper, Plastic, Titanium, and Carbon Graphite?

2008 of course brought the “Visa Black Card“, made from Carbon Fiber. The Wikipedia editors, however, did neglect to include credit cards in applications of carbon fiber (we’re kidding): “The properties of carbon fiber such as high tensile strength, low weight, and low thermal expansion make it very popular in aerospace, civil engineering, military, and motorsports, along with other competition sports.”

2008 of course brought the “Visa Black Card“, made from Carbon Fiber. The Wikipedia editors, however, did neglect to include credit cards in applications of carbon fiber (we’re kidding): “The properties of carbon fiber such as high tensile strength, low weight, and low thermal expansion make it very popular in aerospace, civil engineering, military, and motorsports, along with other competition sports.”